Budget 2024: What to expect from Jeremy Hunt’s pre-election tax giveaway

Jeremy Hunt faces challenges in delivering tax cuts before the election due to a weak economy and a reduced budget deficit. The political impact remains uncertain. Can the chancellor move the dial on the Tories’ grim polling?

Jeremy Hunt faces challenges in delivering tax cuts before the election due to a weak economy and a reduced budget deficit. The political impact remains uncertain. Can the chancellor move the dial on the Tories’ grim polling?

C hancellor Jeremy Hunt’s last budget before the general election will be highly political. His aim on March 6 will be to convince voters that the Conservatives are a tax-cutting party. Standing in his way are a weak economy and unwieldy budget deficit, which keeps adding to the high levels of government debt.

So can he afford tax cuts – and could they change the outcome of the election?

Hunt would like to extend the tax cuts for individuals and businesses that he began in the November autumn statement, cutting employees’ National Insurance (NI) taxes from 12p to 10p in the pound and giving businesses a potential £10 billion in tax relief for investment spending.

But since then, the UK economy has gone into recession and the long-term national finances have worsened. Estimates by the government’s Office for Budget Responsibility (OBR) will likely show that Hunt only has “headroom” for around £13 billion in tax cuts. This is around half the amount that the OBR’s November 2023 forecast predicted would be available (and the pot is even less when you take into account the need to keep some in reserve for emergencies).

The main options

Some people want Hunt to abolish inheritance tax or remove stamp duty on the sale of property. More likely, he’ll take the view that the most politically beneficial tax cuts will be the ones which reach the largest number individuals.

Only 27,000 people in the UK pay inheritance tax, while 20 million pay NI and nearly 32 million pay income tax.

In November, Hunt argued that cutting NI was preferable to cutting income tax as it helped to boost employment at less cost to the government. Cutting income tax, however, could have higher political profile, and is the stated long-term goal of the prime minister, Rishi Sunak.

It could also help to quell the clamour to reverse the freeze on income-tax thresholds that began in 2021. The government has already raised more than £16 billion from this “fiscal drag”, which is projected to add about £44 billion a year to the public coffers by 2028.

But with public debt close to 100% of GDP and the government struggling to reduce its budget deficit (the difference between income and outgoings), this “stealth tax” is likely to continue. Even cutting 1p from income tax would cost £7 billion, while an NI cut would cost £5 billion, so either would use up most of the available headroom.

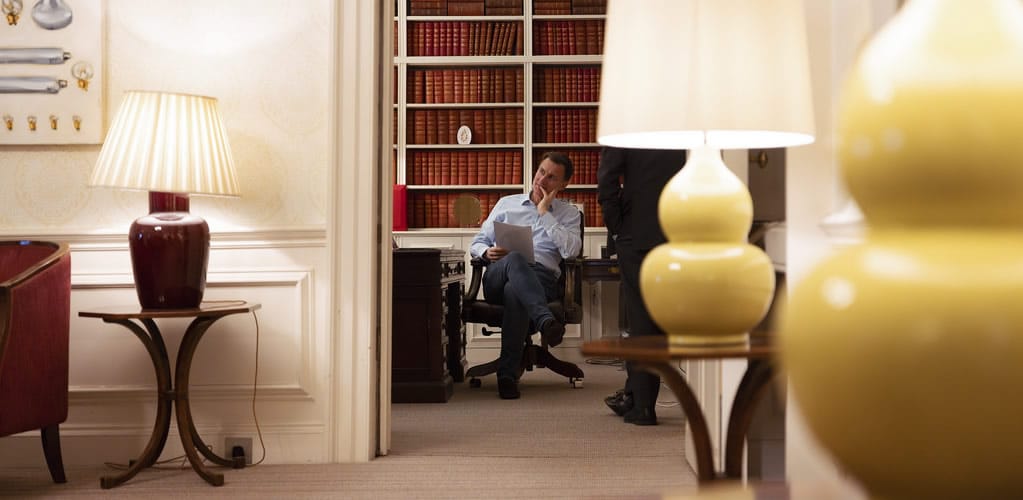

— The Chancellor prepares for the Spring Budget 2024.

Paying for tax cuts – and laying traps for Labour?

To finance bigger tax cuts, the chancellor may announce other ways of raising revenues or cutting spending. He could increase taxes that target only a small proportion of individuals, such as on vapes and tobacco. This would be in line with the government’s aim to stop smoking, and could raise around £500 million.

There is also speculation that he might tax “non-doms”, despite ruling it out in the past. Targeting these individuals living in the UK who claim tax exemption from their foreign income could raise up to £3.2 billion. It would mean stealing a Labour policy, but giving the money away as tax cuts would also undermine the opposition’s plans to spend the proceeds on improving education and the NHS.

In the same vein, Hunt is reportedly considering using Labour’s plan to extend the windfall tax on oil and gas companies beyond 2028. Since Labour has pledged not to raise income taxes or NI, these taxes are crucial to their plans to fund improvements in public services.

As for Hunt cutting future spending, the scope is limited but not insignificant. Spending is already set to increase by just 1% per year to 2028-29, which probably entails cuts once you factor in inflation. Yet lowering that to 0.75% per year is likely to save another £5 billion to £6 billion.

Labour may struggle to accept such a plan. The 1% target has already been compared to “a work of fiction” by Richard Hughes, head of the OBR. He argues that after years of austerity, the government has given no indication of what it could cut without putting vital services at risk, or how it would pay for ambitious plans to expand free childcare and increase the NHS workforce.

Nonetheless, many experts are questioning the logic of the existing spending restrictions. The former chief economist of the Bank of England, Andy Haldane, claims the rules are “stunting” economic growth and constraining the chancellor. But the chancellor thinks any changes might worry financial markets, similar to what happened to Liz Truss in 2022.

And others believe that the government’s fiscal rules, the most important of which is to have debt falling as a share of GDP in five years time, are not a useful guide to policy. The Institute for Fiscal Studies thinks they are so loose as to allow the government to “game the system”. Changing these wouldn’t be impossible: there have been 22 changes since they were first introduced in 1997. However, Labour has pledged to introduce similar rules and spending restrictions if it comes into power.

Will it help win the election?

It is far from clear that tax cuts are what the electorate wants, even among Conservatives. Recent polling suggests the NHS, the economy and the cost-of-living are much higher priorities.

Polls going back years also suggest a shift towards greater concern about the effect of tax cuts on public services. Only 16% of Britons now want them cut, if it means cutting public services, rising to only 17% among Conservative voters. Meanwhile, 31% want increased taxes to improve public services, while 33% want taxes and spending to stay the same.

However, another poll asking what should be the government’s priority in the budget found that 54% backed lowering taxes for people, while only 35% favoured increasing spending on public services.

At any rate, the budget will be an opportunity to judge the public mood and see whether either party can convince the public it can tackle the cost-of-living crisis while improving public services. In particular, all eyes will be on Hunt to see if he can do anything to turn around the government’s moribund polling.

Sources:

▪ This piece was originally published in The Conversation and re-published in PMP Magazine on 5 March 2024. | The author writes in a personal capacity.

▪ Cover: Flickr/HM Treasury. (Licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.)

[Read our Comments Guidelines]